NHBC Warranty: Your Complete 10‑Year New Home Protection Guide

The NHBC Warranty is the UK’s leading insurance-backed protection scheme, covering the purchase of newly built or converted homes. Trusted by lenders and covering around 1.2 million properties, it provides comprehensive defence against builder insolvency, structural defects, and more.

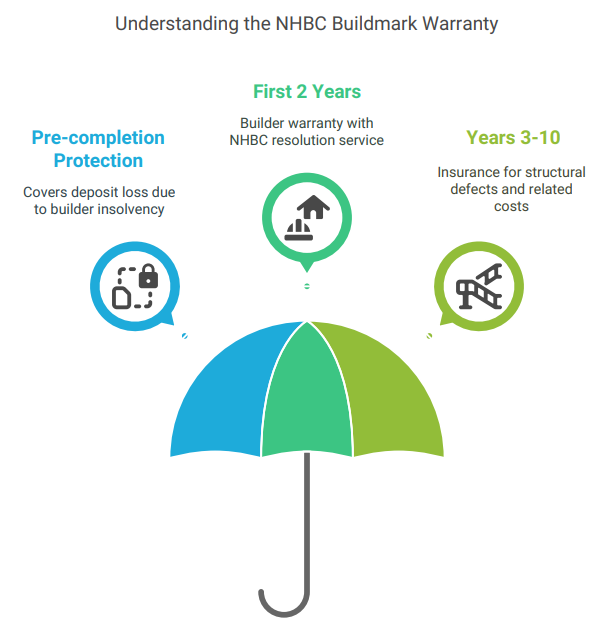

Buildmark spans 10 years, with three distinct phases:

1. Pre-completion protection – covers deposit loss or contract shortfall if a builder becomes insolvent.

2. First 2 years (Section 2) – builder warranty backed by NHBC resolution service.

3. Years 3–10 (Section 3) – insurance for structural defects and related costs.

1. Pre-Completion: Deposit Protection

From exchange to legal completion, NHBC Buildmark insures deposits and any extra payment if a builder goes bust. Typically, this is up to 10% of the purchase price (max £100,000) for the first owner

2. Years 1–2: Builder Warranty + NHBC Guarantee

During this period, the builder must address any defects arising from non‑compliance with NHBC Technical Requirements If disputes arise, NHBC offers a resolution service to mediate and enforce repairs

3. Years 3–10: Structural Insurance

Once the initial two-year warranty ends, NHBC provides its own insurance—covering foundations, walls, roofs, plumbing, and more—for damage from defects. This includes costs for upheaval of furniture or temporary relocation for works

✔ Covered: Structural defects including:

-

- Load-bearing walls, roofs, external doors/windows, chimneys

- Drainage systems

- Required repair costs, plus expenses for storage or temporary accommodation

- Contaminated land remediation

✘ Not covered:

-

- General wear & tear or poor maintenance

- Modifications made after handover (e.g., extensions)

- Damage from weather, accidental damage, theft, or fire

- Issues covered by other providers (e.g., appliance warranties)

Summary of insurance limits:

-

- Individual homes: up to £1 million for new builds, £500k for conversions

- Shared structures: up to £25m for new builds, £5m for conversions

- Coverage increases ~5% annually to match inflation

- Proven history: Operating since 1936, now safeguarding ~80% of UK new homes

- Lender preference: Most mortgage providers require it for new-build lending

- Robust support: Includes NHBC’s trained dispute resolution and nationwide surveyor network.

- Inflation-adjusted cover: Limits escalate each anniversary to help match rising costs

During Years 1–2:

-

- Report defects to your builder ASAP, with photos and communication logs.

- If unresolved, escalate via the NHBC resolution service after using the builder’s complaint process

During Years 3–10:

-

- File directly with NHBC, providing evidence (photos, documents).

- Claims must meet the minimum claim value (MCV)—specified in your policy—otherwise NHBC will decline low-value claims

Accessing your documents:

-

- Email ccsupport@nhbc.co.uk, quoting your name, address, postcode (and policy no. if known)

- Download booklets directly via the NHBC website if you have your policy number

The NHBC Buildmark warranty is more than a requirement—it’s a powerful protection package offering financial security, structural peace of mind, and lender confidence. Remember:

- Activate early: Your solicitor should activate Sections 1–3 at key stages.

- Document everything: Capture defects, maintain communication logs.

- Communicate smartly: Engage builders first, escalate to NHBC when needed.

- Review limits: Understand your policy limits and remaining coverage—especially as a subsequent buyer.

Your new home is your largest investment—NHBC Buildmark ensures that it’s also your most secure one.

Frequently Asked Questions

What is covered during the first two years under the NHBC Buildmark warranty?

What does NHBC cover in years 3 to 10?

Years 3 to 10 are covered by NHBC Buildmark insurance, protecting against major structural defects—such as issues with foundations, load-bearing walls, roofs, and external weatherproofing. This insurance typically includes accommodation and storage costs if your home becomes uninhabitable due to a covered defect.

When does NHBC’s pre-completion protection come into effect?

Buildmark’s pre-completion coverage begins at exchange of contracts. It covers the deposit you’ve paid (up to 10% of the purchase price, capped) and additional costs needed to complete the home if the builder becomes insolvent before completion.

How much financial protection does Buildmark provide?

Buildmark insurance typically covers structural issues up to substantial sums—often up to £1 million for new-build homes and £500,000 for conversions. It also provides funding for alternative accommodation and storage if work to your home means you can’t occupy it.

What is the NHBC Dispute Resolution Service?

NHBC offers a Dispute Resolution Service during the first two-year builder warranty. Homeowners must report defects in writing within that period. If the builder does not address the issue, NHBC intervenes to assess and resolve the defects and, if necessary, enforce repairs or complete the work.

Are there things NHBC Buildmark does not cover?

Yes—certain exclusions apply. These typically include general wear and tear, maintenance issues, neglect, storm/weather damage, and cosmetic snags not resulting from construction defects. Claims must also meet a minimum threshold (Minimum Claim Value) based on the policy’s terms.